Utilities, Endowments, Equilibrium

October 13, 2020

Yale Financial Markets Lecture 2

Model

- Exogenous variables $e$ (incontrollable variables)

- Endogenou variables $x$ (prices, consumption, predictable variables)

- Equilibrium conditions $F(e,x) = 0$

- Equilibrium $x(e)$ s.t. $F(e, x(e)) = 0$

- Comparative Statics -> what happens when you change $e$.

Why models?

- Prediction, understanding

- Properties of equil

Ricardo: first economic model- principle of comparative advantage. Malthus: Models are based on assumptions, which propagate errors

Market Mechanisms

- Seller determined prices

- Haggling

- Govt price regulation

- Paris Bourse - tatonnement

- Commodities futures pit

- Bid/Ask prices

NYSE Beginnings

- Founded in 1792 by 24 brokers on wall stree

- Only 5 securities traded. 3 war bonds, 2 bank stocks

- Sold in a double auction format

Walrus 1871

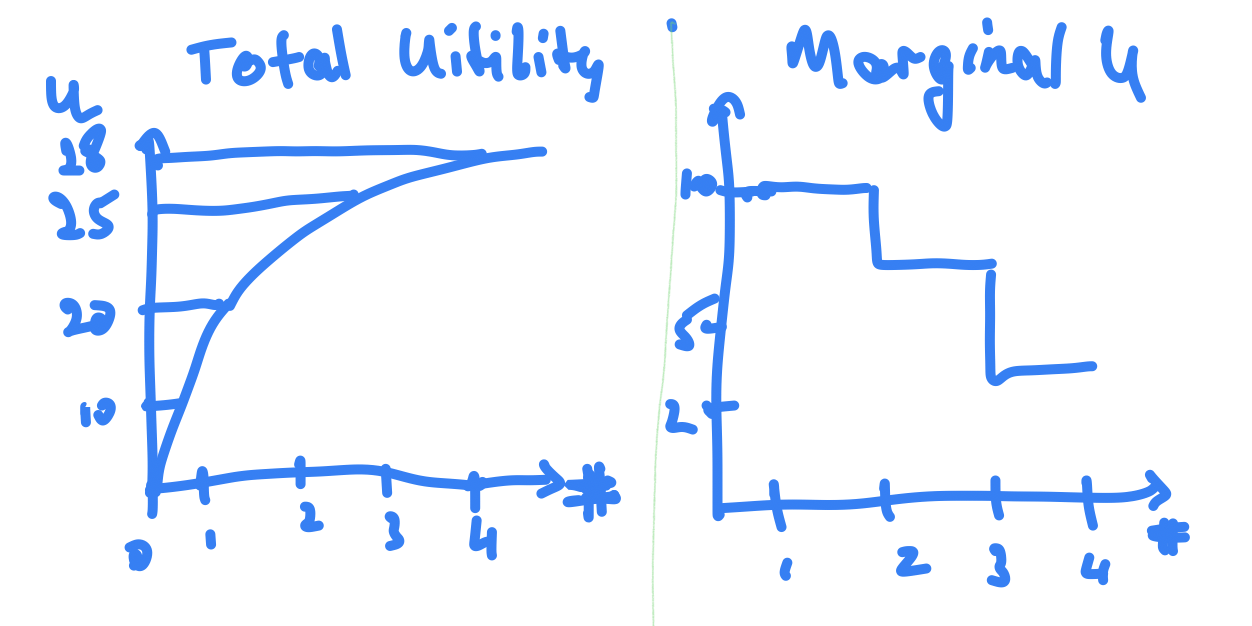

- Marginal utility

- Utility increases with more stuff but at smaller and smaller rate.

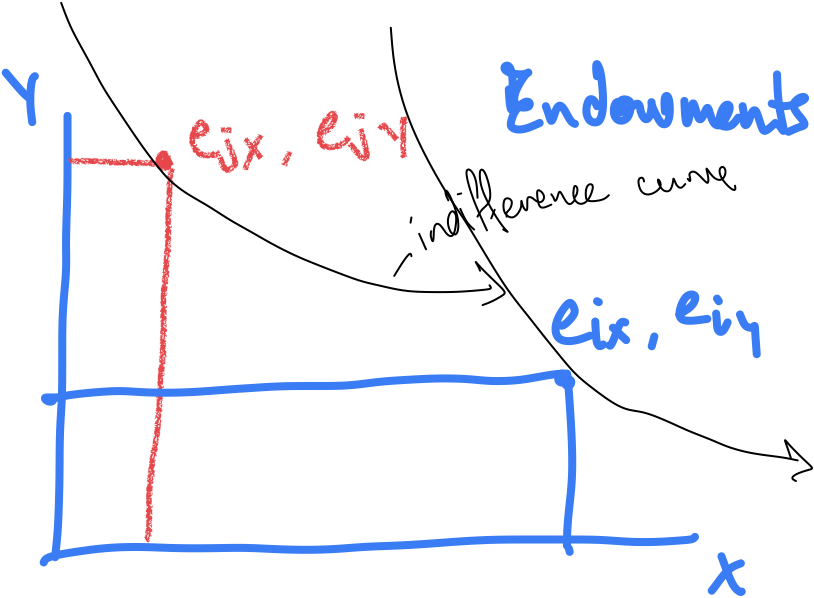

Endowments (what do I have?)

- $x$ is money

- $y$ is goods

General Equilibrium Model

Exogenous Variables

- Individual $i \epsilon I$ where each $i$ has a utility and an endowment

- Welfare $W_i(x, y) = u_i(x) + v_i (y)$

- $y$ is money

- $x$ is football tickers

- Endowment $e_i = (e_{ix}, e_{iy})$

- Welfare $W_i(x, y) = u_i(x) + v_i (y)$

Endogenous Variables

- Prices $(P_x, P_y)$

- Trades, or final consumptions $(x, y)$

Equilibrium

\[F(e, x) = 0\]Budget set of agent $i$ is the linear trade-off between $x, y$ defined by:

\[P_x(x^i - e_{ix}) + P_y(e_{iy} - y^i) = 0\]Final consumption must equal final endowment.

General Equilibrium for 2 agents:

- $\sum_i x_i = \sum_i e_{ix}

- $\sum_i y_i = \sum_i e_{iy}

- $P_x(x^i - e_{ix}) + P_y(e_{iy} - y^i) = 0$

- $P_x(x^j - e_{jx}) + P_y(e_{jy} - y^j) = 0$

- $\frac{MarginalUtility_i(x)}{MarginalUtility_i(y)} = \frac{P_x}{P_y}$

- $\frac{MarginalUtility_j(x)}{MarginalUtility_j(y)} = \frac{P_x}{P_y}$